How are the tax advances determined?

Each year, taxpayers receive a tax advance schedule detailing the required advances for Corporate Income Tax (CIT), Municipal Business Tax (MBT) and Net Wealth Tax (NWT), if applicable.

The amount of these tax advances is based on information available to the Luxembourg tax authorities (LTA), such as the latest tax assessment.

Following each tax assessment, the LTA automatically updates the requested tax advances according to the most recent tax charges calculated.

When the tax assessment is issued, any tax advances previously paid for a given year are automatically deducted from the assessed tax charges, with only the remaining balance, if any, to be settled.

What is the deadline for the tax advance payment?

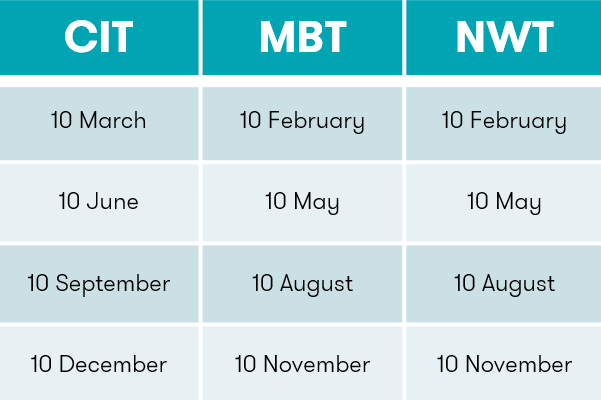

Tax advances must be paid quarterly, before the following deadlines:

In the event of late payment, the LTA will impose a 0.6% monthly interest charge starting from the month following the missed due date.

To avoid missed payments, and depending on the company’s cash flow, it is also possible to pay the entire tax advance amount or multiple installments in a single payment before the quarterly deadlines.

What information should be included on the payment order?

To ensure correct allocation of payments by LTA, please include the following details on the payment order:

- Taxpayer’s tax number (11 digits)

- Tax category (e.g.CIT, MBT, NWT)

- Relevant period

For example, to pay the NWT advance for the first quarter of 2025, use the following format in the payment communication: 2020 1234 567–NWT advance –Q1 2025.

Please note that tax advances are aligned with the calendar year, regardless of the taxpayer’s accounting year-end.

Tax Tips - What you should know about Tax Advances

Download our Tax Tips below