Tax Calendar 2025

Stay ahead of Luxembourg tax compliance

Tracking tax deadlines is becoming increasingly challenging as regulations evolve rapidly. Missing deadlines can result in costly fines and penalties, jeopardising both the company’s financial results and its reputation.

Managing tax obligations is not just about avoiding fines or penalties, it can also represent a strategic advantage. Meeting deadlines can improve treasury management, support better decision-making, and reduce financial uncertainties. Furthermore, proactive management of tax deadlines can uncover opportunities for tax mitigation, helping businesses enhance their efficiency and focus on growth.

To help you manage these obligations efficiently, we are excited to introduce TaxCalendar.lu, an online tool designed to keep you on track with your tax deadlines.

How does our Tax Calendar work?

The Tax Calendar provides an overview of key tax deadlines and is customisable to suit your business needs. Whether you require a comprehensive list of deadlines or a tailored view, TaxCalendar.lu offers both clarity and flexibility.

A practical tool that helps you:

- Stay on top of key tax deadlines related to corporate income tax, withholding tax, VAT, FATCA/CRS, CbCR, DAC6, and DAC7.

- Avoid incurring penalties by ensuring compliance with Luxembourg regulations by never missing a deadline.

- Plan proactively by identifying opportunities to mitigate taxes and improve process.

Don't wait to get your customised Tax Calendar

Adapt this calendar to your needs and meet your tax deadlines efficiently!

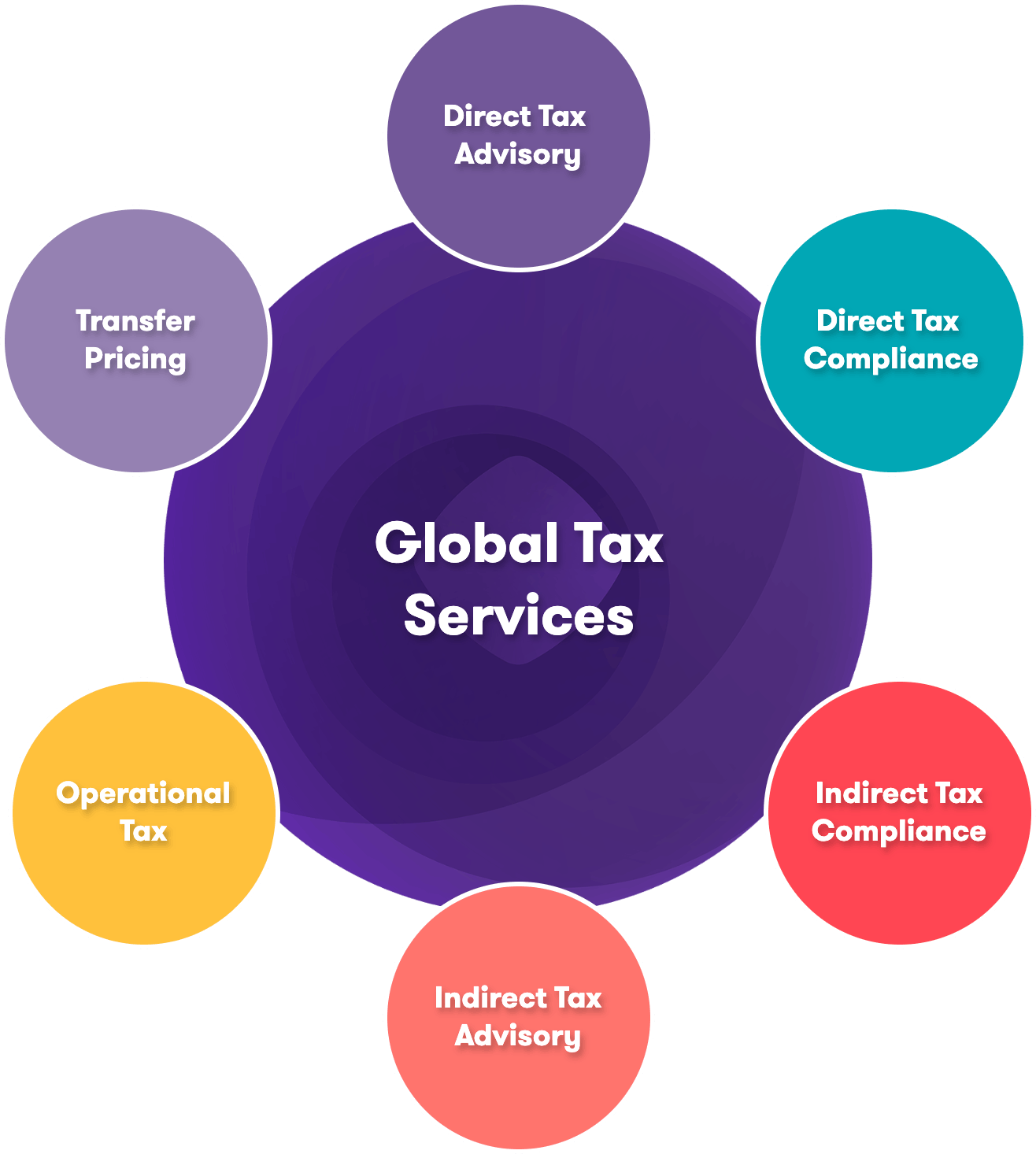

Grant Thornton Luxembourg goes beyond tax services

Any questions? Contact our tax experts