Background

BEFIT was first announced in May 2021 in the EC’s Communication on Business Taxation for the 21st Century. The EC considers that common rules to calculate the taxable income of businesses operating in the EU are needed because it is difficult and costly for businesses to comply with (up to) 27 different national tax systems. The Proposal aims to create a level playing field, enhance legal certainty, reduce compliance costs, encourage businesses to operate cross-border, and stimulate investments and growth in the EU.

1. Entities in scope

The BEFIT proposal provides for a hybrid scope for the application of the rules, namely a mandatory and a voluntary one. The former covers:

- Domestic and MNEs operating in the EU, either headquartered in the EU or in a third country with an annual global turnover of at least EUR 750 million in at least two of the last four fiscal years; and

- Where the ultimate parent entity (“UPE”) holds, directly or indirectly, at least 75% of the ownership rights or of the rights giving entitlement to profit.

However, for groups headquartered in third countries, the rules of the Proposal will not apply if in two of the last four years, the combined revenues of the group’s EU subsidiaries and permanent establishments (“PEs”) do not exceed (i) 5% of the total group revenues or (ii) EUR 50 million.

There is also a voluntary application of the rules for entities which prepare consolidated financial statements and for which the abovementioned scoping thresholds are not met.

2. Common rules to calculate the tax base

To calculate the BEFIT tax base, each member of the BEFIT group will compute its preliminary tax result by adjusting its financial accounting net income or loss for the financial year as determined by a single accounting standard. In particular, this is the standard used in the preparation of the consolidated financial statements of the UPE.

This mechanism could resemble the Global Anti-Base Erosion Model Rules (“Pillar Two”), however, it involves fewer adjustments. Consequently, achieving compliance should, in theory, pose fewer challenges for MNEs within its scope. However, it is worth noting that potential duplications in calculations could arise if companies are required to independently ensure compliance with both regulatory frameworks.

3. Aggregation of the tax base at EU group level

Following the calculation of the preliminary tax result, the tax bases are aggregated to the BEFIT tax base. In case the BEFIT tax base is positive, the profit is allocated among the entities. In the case the tax base is negative, the loss is carried forward and shall be set off against the next positive BEFIT tax base.

4. Allocation of the aggregated tax base

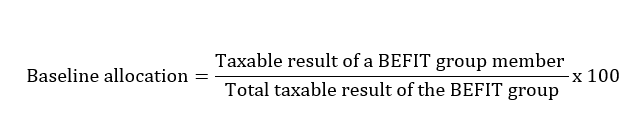

The BEFIT taxable base is allocated to the BEFIT group members under a baseline allocation percentage and is determined as follows:

Where:

- the taxable result of a BEFIT group member: the average of the taxable results in the three previous fiscal years

- taxable result of the BEFIT group: the addition of the average of the taxable results, as referred to in point (i), of all BEFIT group members in the three previous fiscal years.

Additionally, in case a BEFIT group member has a negative taxable result, it shall have its baseline allocation percentage set at zero.

5. Member States’ taxation autonomy

Based on the Proposal, Member States retain the flexibility to adjust their portion of the tax base using national regulations. This flexibility allows Member States to tailor their tax systems to align with their unique tax policy objectives.

This could encompass local tax incentives or deductions, provided they remain consistent with the Pillar Two requirements. It is important to note that Member States retain control over tax rates and enforcement policies.

6. Simplified TP approach

The Proposal introduces a simplified TP approach for assessing intercompany transactions involving low-risk distribution and manufacturing activities between a member of the BEFIT group and associated enterprises outside the BEFIT group. In this approach, taxpayers will have their results compared with a regional benchmark analysis prepared by the EC.

Based on this comparison, taxpayers will be classified as low, medium, or high risk, which will have an impact on the probability of tax audits or inquiries by tax authorities.

7. Our observations

If adopted, Member States should implement BEFIT by 1 January 2028 and apply its provisions from 1 July 2028. We anticipate that BEFIT might have a major impact on the tax calculation and administration of MNEs with a European footprint.

While it is not yet possible to anticipate whether the Proposal will eventually be adopted (unanimous approval by EU Member States is required), we would recommend to businesses in scope to carefully monitor the development of the Proposal.

Should you have any questions on that matter, please do not hesitate to reach out to the Tax team at Grant Thornton Luxembourg.

- Jean-Nicolas Bourtembourg - Partner, Head of Tax & Transfer Pricing

- Mélina Rondeux - Partner, Tax Compliance